However, the current market volatility and chances of a market correction are expected IBEX 35 index to remain under pressure in the near term. Immediately after this step, ZFX will display your MT4 login and password, as well as invite you to download the platform. Indeed, you will use MT4 to trade SPAIN35 and other instruments of your choice.

Given the relatively low brokerage and commission charges on CFD trades, investing in the IBEX 35 index through such instruments can reap relatively higher returns. The IBEX 35 index lost 9 billion euros due to pandemic in 2020, with banking and tourism deemed as the worst performing sectors. While the economy has improved significantly since then, the emergence of more resilient versions of the virus are expected to have an impact on the index performance in the near future.

IBEX 35 : Periodical High, Low & Average

Also unique to Barchart, Flipcharts allow you to scroll through all the symbols on the table in a chart view. While viewing Flipcharts, you can apply a custom chart template, further customizing the way you can analyze the symbols. Most data tables can be analyzed using «Views.» A View simply presents the symbols on the page with a different set of columns. Pages are initially sorted in a specific order (depending on the data presented). You can re-sort the page by clicking on any of the column headings in the table. The Cash Contract is listed as the first contract at the top of the page.

- Institutional investors from across the world, money managers and retail investors partake in IBEX 335 investing, as the index represents 90% of the cash traded in the Spanish markets.

- The substantial bailout package provided by the European central bank also caused the currency value to fall, negatively impacting the Spanish economy and stock markets.

- As the index tracks 35 of the most liquid stocks traded in the Spanish stock exchange, it is highly volatile.

However, depreciation of the Euro can cause the IBEX 35 index to plummet, as global investments decline. With t the moment of calculation; Cap the free float market cap of a specific listing and J a coefficient used to adjust the index on the back of capital increases or other corporate actions so as to ensure continuity. The formula can be adjusted to accommodate changes in index structure, such as the temporary suspension of companies pending news. While the index has a bullish long term outlook, the current market uncertainty due to the Evergrande crisis and delicate geopolitical situation can result in a pullback soon.

IBEX 35 Index List of Stocks

A company will be successful if it offers good products and services at a fair price while being run by honest, capable managers. Over the long run, such companies tend to appreciate and go up in value. About ibexibex helps the world’s preeminent brands more effectively engage their customers with services ranging from customer support, technical support, inbound/outbound sales, business intelligence and analytics, digital demand generation, and CX surveys and feedback analytics. Barchart Plus Members have 10 downloads per day, while Barchart Premier Members may download up to 250 .csv files per day. Unique to Barchart.com, data tables contain an option that allows you to see more data for the symbol without leaving the page. Click the «+» icon in the first column (on the left) to view more data for the selected symbol.

The IBEX 35 is the benchmark stock market index of Madrid, Spain’s principal stock exchange. Trading on options and futures contracts on the IBEX 35 is provided by MEFF. The IBEX 35 is a benchmark index tracking the is black and white a color top 35 most traded and liquid stocks listed in Spanish stock exchanges. It is a market capitalization weighted index adjusted by free float and is tracked globally to determine the position and performance of Spain.

If the hound-of-hell heat wave wasn’t enough, Spain’s political temperature is also soaring ahead of divisive weekend election

Ibex is not providing a quantitative reconciliation of forward-looking non-GAAP adjusted EBITDA margin to the most directly comparable GAAP measure because it is unable to predict with reasonable certainty the ultimate outcome of certain significant items without unreasonable effort. These items include, but are not limited to, non-recurring expenses, fair value adjustments, and share-based compensation expense. These items are uncertain, depend on various factors, and could have a material impact on GAAP reported results for the guidance period. Domestic filing status and US GAAP conversionAs of July 1, 2023, we became a domestic filer and are reporting our financial results in accordance with US GAAP, rather than IFRS.

Dow Surges 150 Points; US Economy Grows At 2.1% Pace In Q2 By … — Investing.com UK

Dow Surges 150 Points; US Economy Grows At 2.1% Pace In Q2 By ….

Posted: Wed, 30 Aug 2023 14:04:00 GMT [source]

View the latest top stories from our trusted partners, with a focus on today’s futures and commodity markets. For dynamically-generated tables (such as a Stock or ETF Screener) where you see more than 1000 rows of data, the download will be limited to only the first 1000 records on the table. For other static pages (such as the Russell 3000 Components list) all rows will be downloaded. In conclusion, we’ve seen that IBEX 35 is a global benchmark index for the Spanish economy. Investors, money managers as well as financial institutions worldwide track it carefully.

IBEX Overview

The All Futures page lists all open contracts for the commodity you’ve selected. Intraday futures prices are delayed 10 minutes, per exchange rules, and are listed in CST. Overnight (Globex) prices are shown on the page through to 7pm CT, after which time it will list only trading activity for the next day. Once the markets have closed, the Last Price will https://1investing.in/ show an ‘s’ after the price, indicating the price has settled for the day. The IBEX 35 serves as a domestic and international benchmark for the Spanish economy. As international capital inflows and foreign portfolio investments often come in through stock market investments, any development on the global front has a substantial impact on the IBEX 35.

- The formula can be adjusted to accommodate changes in index structure, such as the temporary suspension of companies pending news.

- About ibexibex helps the world’s preeminent brands more effectively engage their customers with services ranging from customer support, technical support, inbound/outbound sales, business intelligence and analytics, digital demand generation, and CX surveys and feedback analytics.

- IBEX 35 stock constituents are reviewed twice a year by the Technical Advisory Committee of Sociedad da Bolsas, and any changes to the index composition are made accordingly.

- When these impacts are factored into our previously provided guidance issued under IFRS, the results align with our previous guidance.

- For other static pages (such as the Russell 3000 Components list) all rows will be downloaded.

- However, new stocks are not automatically added to or re-ranked on the page until the site performs its 10-minute update.

It was thus able to reach an all-time-high of over 15,945 in November 2007. Constituents of the IBEX 35 index are reviewed semi- annually, in June and December of each fiscal year. Follow ups regarding the same are conducted in March and September each year. Only companies with the highest liquidity and trading volume are eligible for addition in this benchmark.

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world’s media organizations, industry events and directly to consumers. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. For reference, we include the date and timestamp of when the list was last updated at the top right of the page. End-of-Day prices are updated at 8pm CST each evening, and includes the previous session volume and open interest information. Investors can bet on the Spanish economy by investing in IBEX 35 ETF or through contracts for difference (CFDs).

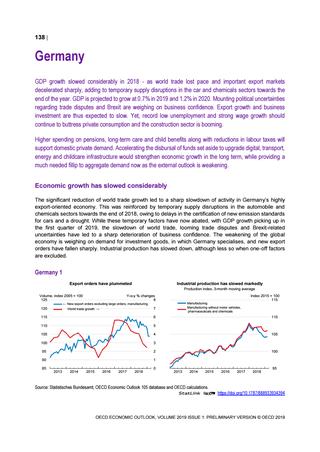

The country’s impressive recovery in 2021 is reflected in the benchmark index’s double digit price gains. Spain’s GDP is to reach pre-pandemic levels in 2022, as forecasted by the country’s Economy Minister Nadia Calvino. This has been the driving force behind the bullish stock markets, and impressive IBEX 35 index performance. Strong consumer spending, resulting in increased interest in IBEX 35 investing, should lead to the continuation of this bullish trend. The list of symbols included on the page is updated every 10 minutes throughout the trading day. However, new stocks are not automatically added to or re-ranked on the page until the site performs its 10-minute update.

The two significant accounting impacts from this change are in lease and warrant accounting. When these impacts are factored into our previously provided guidance issued under IFRS, the results align with our previous guidance. Moreover, in 2019, the index fell below the critical level of 9,000 after the United Kingdom and European Union failed to reach a trade agreement following the Brexit. Furthermore, IBEX 35 took a sharp hit during the Greek debt crisis in 2011, which threatened regional stability during the time. The substantial bailout package provided by the European central bank also caused the currency value to fall, negatively impacting the Spanish economy and stock markets. The macroeconomic parameters play a major role in the IBEX 35 performance.

As a Euro-denominated index, IBEX 35 is highly susceptible to the majority of the developments in the Eurozone. As stated above, IBEX 35 includes the most liquid stocks trading on the Spanish stock exchanges. While liquidity is given more importance compared to the size of a company, a minimum market cap is required for a publicly traded stock to be added to the IBEX 35. Moreover, the average capitalization of stock on the index should be higher than 0.30% to be eligible for inclusion. Also, a stock is required to be traded in at least one third of the trading days during the control period (a full six month period between ordinary meetings to decide any potential changes to the index). In case the trading requirement is unmet, companies ranking within the top 20 stocks in terms of market capitalization are also considered.

Analysts expect the U.S. markets to witness a market correction, which then might impact major European markets and benchmark indices such IBEX 35. The IBEX 35 index is highly responsive to any news on the domestic or international front. As the index comprises 35 most liquid stocks, a market pullback or recession patterns can be noticed through the IBEX 35 trends. The week of the January 2008 stock market downturn was characterised by extreme volatility in the markets, and saw both the biggest one day percentage fall and rise in the IBEX 35’s history. The index closed 7.5% down on 21 January 2008, the second biggest fall in the Spanish equity market since 1987, and rose a record 6.95% three days later.

Moreover, with 34.89% of GDP coming from exports, Spain’s international relations have a tremendous impact on its stock markets. IBEX 35 is the benchmark stock market index comprising 35 biggest and most liquid stocks listed in the Bolsa de Madrid, which is Spain’s largest stock exchange. Created on January 14th, 1992, it is a relatively new index tracking the Spanish markets.

Scroll through widgets of the different content available for the symbol. The «More Data» widgets are also available from the Links column of the right side of the data table. If you wish investing in the index, you can do so in just a few simple steps through ZFX. This is a leading, regulated and efficient broker to trade IBEX35 as well as many other international assets. 1The tax impact of each adjustment is calculated using the effective tax rate in the relevant jurisdictions.

The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain’s principal stock exchange. Initiated in 1992, the index is administered and calculated by Sociedad de Bolsas, a subsidiary of Bolsas y Mercados Españoles (BME), the company which runs Spain’s securities markets (including the Bolsa de Madrid). It is a market capitalization weighted index comprising the 35 most liquid Spanish stocks traded in the Madrid Stock Exchange General Index and is reviewed twice annually. Trading on options and futures contracts on the IBEX 35 is provided by MEFF (Mercado Español de Futuros Financieros), another subsidiary of BME.