Content

- The extent to which the work performed by the worker is an integral part of the alleged employer’s business.

- The degree to which the worker’s opportunity for profit and loss is determined by the alleged employer

- How Mimo manages a global team of employees and contractors with Remote

- Employee Laws in Florida

- Use Form SS-8 to get an official ruling from the IRS

- Key Differences Between Employee and Independent Contractor

Employee — If they work a set amount of hours each week dictated by the employer they are likely an employee. The Zegal online contract management platform allows your team to work seamlessly on all your legal contracts. If you’re scaling and growing a company, contractors are an excellent option as they allow you to move quickly and flexibly. Autonomy is one of the key criteria used by authorities to determine correct worker classification. For instance, consultants who work for consulting firms may be considered employees of those firms.

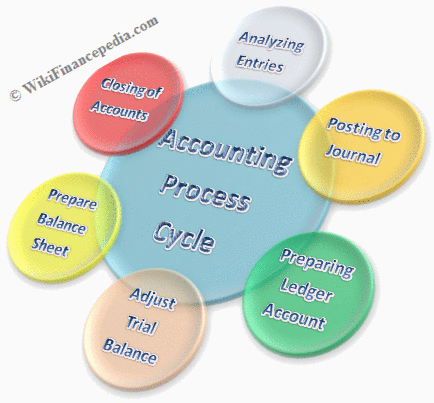

W-2s and 1099s are just some of the tax forms you need to use when you hire employees and contractors. For information on the other forms, consult the IRS website or your https://kelleysbookkeeping.com/ accountant. The difference between an employee and an independent contractor is the degree of control you have over the worker or the amount of independence they have.

The extent to which the work performed by the worker is an integral part of the alleged employer’s business.

However, independent contractors are not an employees of the company they are contracting with, therefore, they are not subject to the same rules and regulations of federal employee law. You enter into a contract with an independent contractor to do a specific role or complete a specific task. Since they are self-employed, you do not withhold taxes from their paychecks; they pay their own taxes and provide their own benefits. Independent contractors don’t require training since the client hires them for their expertise.

I submitted a bid that works best for my business and we went forward with the project. Employees

are people who work for an employer that controls what the employee does. In other words, the employer controls the how, where, and when the employee performs its work. To prevent any unwanted surprises, it is essential to define the exact business relationship between you and your employer prior to beginning work. The information provided in the MBO Blog does not constitute legal, tax or financial advice.

The degree to which the worker’s opportunity for profit and loss is determined by the alleged employer

Think of your relationship with an independent contractor as a business-to-business relationship. It can be easy to fall into the trap of treating them like an employee, but doing so can put you at risk for misclassification. Enterprises need the flexibility independent contractors can provide and their skillsets are in high demand. Independent talent can give businesses a cutting edge by providing on-demand expertise, financial savings, and staffing flexibility.

- In the case of Carmicheal v National Power Plc, there was no mutuality of obligation on the casual workers who were power station tour guides.

- There are many ways in-house counsel can demonstrate their value to the company.

- The contractor on the other hand is free and the party offering the services has responsibility over the work that has been assigned.

The exact tax percentage that an independent contractor pays can vary, but it’s important to be aware of the additional taxes that may be owed. Independent contractors who are not aware of the tax implications of their work may end up owing a significant amount of money at tax payment time. There are many different types of independent contractors, and it can sometimes be difficult to determine whether someone is an independent contractor or an employee. While an independent contractor has many advantages, such as the ability to set their own hours and rates or their own business processes, they also carry more risk than traditional employees.

How Mimo manages a global team of employees and contractors with Remote

Contractors are entitled to decide when, where, how, and even who completes the work, provided that the deliverables meet the terms of the agreement. The current

patchwork of laws across the United States makes it difficult What Is The Difference Between Employee And Independent Contractor? for individuals

and potential employers to differentiate between independent contractors and

employees. Clarifying this confusion is important because of the harm mistakes

may inflict on both workers and employers.

- In 2016, Uber paid a $100 million settlement for federal tax evasion because of employee misclassification.

- With independent contractors, there are no such requirements, and the employer is only responsible for the payment of the contractor’s invoices.

- Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

- Consultants are professional experts who offer advice and assistance to businesses in a specific field.

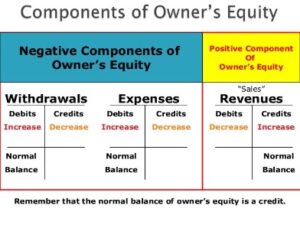

- The employer is responsible to deduct federal and state taxes as well as Social Security and Medicare taxes from their income.

- Self-employment is now a viable career option for more people than ever before, and more companies are seeing the benefits of engaging independents vs employees.

Conversely, if you’re a US-based business and you hire contractors abroad, you will need to submit a 1042-S form to the IRS on their behalf. Independent contractors are typically not eligible for this insurance, which can be a source of concern for some workers who engage in higher-risk work. Independent contractors are self-employed and therefore have a higher level of control. They can decide how and where they will complete the work, and at what rate of pay. Independent contractors are free to decide on their work hours, rates, and methods, while employees are subject to stricter requirements imposed by the employer. However, they will vary depending on whether the legal agreement is signed by a contractor or an employee.

Another major difference between a contractor and an employee relates to their level of independence. Prince Edward Vayeya interesting piece, would you be able to carry out another piece that relates to technology and remote work? This is a growing trend and there is little information available regarding how this would work particularly from a tax perspective. The plaintiff, Hill, was granted a lease of land on the side of the Basingstoke Canal by the canal company. The lease also gave the plaintiff the sole and exclusive right to put pleasure boats for hire on that stretch of the canal…. Specialized skills relate to people’s specific talents or capabilities, and whether those skills make them fit for a job.

Employees may also have a fixed hourly wage if their working hours are not the same every week. The test also factors in such things as level of skill, integral nature of the work, intent of the parties and payment of social security taxes and benefits. In an attempt to interpret provisions of the Fair Labor Standards Act and discern between employee and independent contractor status, some courts and federal agencies have come up with the «economic realities test.»

During peak business periods, to perform services that are not a part of an employer’s regular business or to work on a special assignment, employers may turn to independent contractors to fill those roles. Independent contractors are responsible for their own taxes, therefore employers are not required to pay employment taxes or to withhold state, federal, or local taxes from paychecks to independent contractors. Independent contractors are not entitled to benefits from the company, such as health insurance or retirement, and are ineligible for unemployment benefits.

Trying to figure out the difference between independent contractors and employees and when to use 1099s and W-2s can be confusing and overwhelming. If you have any questions about employee classification or the different between an employee and independent contractor, it is best to consult a highly trained employment lawyer for guidance. A good starting place could be to look at if the employment falls under one of the different types of employment contracts. With Deel Shield, we classify and hire contractors in 150 countries on your behalf to eliminate your misclassification risk and liability. We also enable you to fund payroll with just a click and automatically calculate taxes without lifting a finger. Managing independent contractors typically only involves the client controlling the outcome of the contractor’s work, not the process.

Use Form SS-8 to get an official ruling from the IRS

There are many differences between 1099 contractors and W2 employees defined by nuances and exceptions in the governing laws, tests, and definitions of these two types of workers. Marketplace gives you access to projects at top companies who value independent talent. Build your business by finding projects that meet your needs and creating long-term relationships with clients who can easily re-engage your services. If a layoff were to occur, employees are likely eligible to receive unemployment compensation. They may also receive workers’ compensation benefits for any injury occurring in the workplace.